- Home

- About Japan Federation of Certified Public Tax Accountants' Associations

- Training and Education

|

About Japan Federation of Certified Public Tax Accountants' AssociationsTraining and Education offered by the FederationCertified public tax accountants are required to enhance their professional ability and quality by attending training programs as stipulated in the CPTA Law (Article 39-2). The Federation offers various types of training to our members. Nationwide Uniform Study Meetings

In cooperation with the 15 regional Associations, uniform study meetings are convened in each location with the theme related to tax laws, company laws, revision of the taxation system, professional services, etc. Open Forum

With the 15 regional Certified Public Tax Accountants’ Associations gathered into seven groups, research and discussion meetings are annually held among them, during which their daily study results are presented, followed by Q&A sessions, each assembly aiming to improve and streamline the taxation system, taxation administration, etc. Multi-media Training

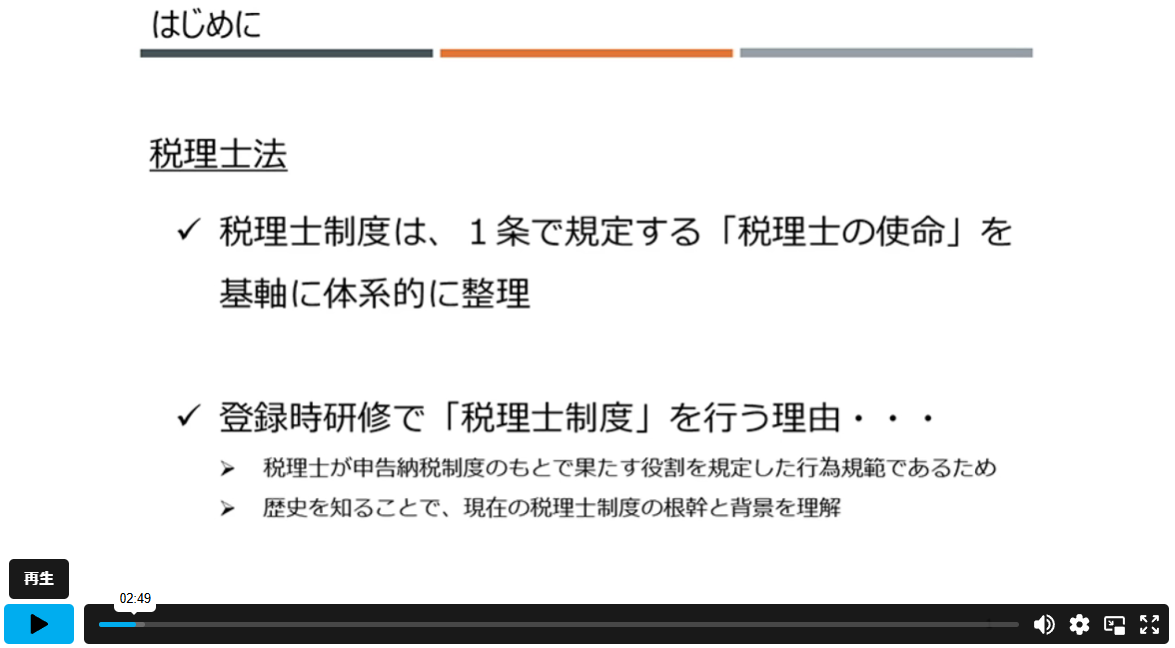

As a training program for our advanced information age, multi-media education is offered for the benefit of as many certified public tax accountants as possible through Internet. Training at Time of RegistrationTraining is conducted for certified public tax accountants within one year from the time of their registration. The training subjects mainly relate to the professional law, the outline of tax laws, other relevant laws including the Constitution, the civil act, the company act, procedures laws and administrative laws, and other professional knowledge. |